7 ways to save money in your 30s

We’ve all done it. I know I’ve been guilty of it. Waiting or putting off on having the savings conversation and when you finally have it, you’re thinking WTF!!! Why didn’t I have this conversation sooner? Trust me when I say you’re not alone. It’s not a joyful conversation to have but it’s one of the most necessary conversations…especially as we get older.Studies show that 47% of Americans don’t have at least $1,000 in their checking/savings in case of emergencies. 47%!!! I’m no math wizard but that’s almost half the American population that doesn’t have at least $1,000 let alone a decent sized savings account. Dave Ramsey suggests having at least 3-6 months in a savings account but if you don’t even have $1,000, the daunting tasks of savings thousands can be pretty intimated.A few years ago, I started adapting small changes to save and it has really paid off for me. I’m 30 with at least 4 months of savings in personal savings account, my 401k has 1.5 times my salary and I still was able to travel when I wanted, go to destination weddings when needed, and afford emergencies that came up. My methods aren’t for everyone but I hope some of the tips/tricks can help you get to a financial situation where you aren’t cursing or questioning life every time you look at your savings account.

I. Invest in your 401k immediately

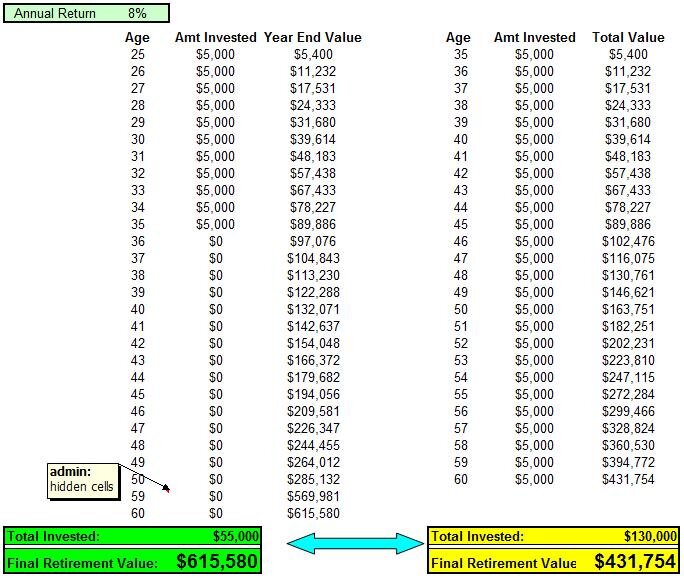

This wasn’t something I had to debate with myself on. Working in the Finance/Accounting field, I knew that I wanted to have a nice 401k when it came to retire. My first job out of college matched my 401k contributions up to 6%. I initially started contributing 4% and every year increased 1% until I maxed out. We got merit raises from anywhere between 3-5% each year so the 1% wasn’t that big of a change. Many people say that they will wait until they get out of debt to contribute but 4% compounded annually for 40 years is a lot higher than 4% compounded annually for 10 years. Take a look: When I moved companies, I took my 401k with me and rolled it into my new 401k (make sure you are vested (taking 100% of your retirements savings) before moving companies. My previous company had a 3 year 100% vested rule so I made sure I did 3 full years before leaving. Leaving companies any time before you’re fully vested is leaving money on the table and who does that?

When I moved companies, I took my 401k with me and rolled it into my new 401k (make sure you are vested (taking 100% of your retirements savings) before moving companies. My previous company had a 3 year 100% vested rule so I made sure I did 3 full years before leaving. Leaving companies any time before you’re fully vested is leaving money on the table and who does that?

II. Start small when it comes to personal savings

I was that person out of college: new job and new debt. I knew I should start saving but I was unsure how much to save and how much to use to pay down debt. This will depend on each person but I started saving 5% of my check and each year in increased to 5% until I reached 20%. If there was a year where I got a bonus that went straight to savings. I didn’t budget for it to pay down debt or taking vacations so anything unexpected when to the savings account. Some analyst suggest 20% savings but they are included your 401k into that calculation. I currently have 7% 401K contribution (the most my company will match) so that would only mean me savings 13% of personal savings. If there are months where things come up unexpected and I have to take out some planned savings money, I make sure I save at least 13%.

I was that person out of college: new job and new debt. I knew I should start saving but I was unsure how much to save and how much to use to pay down debt. This will depend on each person but I started saving 5% of my check and each year in increased to 5% until I reached 20%. If there was a year where I got a bonus that went straight to savings. I didn’t budget for it to pay down debt or taking vacations so anything unexpected when to the savings account. Some analyst suggest 20% savings but they are included your 401k into that calculation. I currently have 7% 401K contribution (the most my company will match) so that would only mean me savings 13% of personal savings. If there are months where things come up unexpected and I have to take out some planned savings money, I make sure I save at least 13%.

III. Use apps to help you save

TipYourself is one of my FAVORITE savings apps. It’s basically an online piggy bank. Have money left over from your previous check that you don’t need? Send it to the app. Have a freelance/collaboration job you we’re expecting? Send it to the app. It’s a great way of sending over small amounts of money over the year without realizing it. I used the money I accumulate each year to pay for Christmas gifts. I don’t have to worry about going into debt and I can see how much I have at any given time. (FYI: this isn’t sponsored or paid; I just really love this app).

TipYourself is one of my FAVORITE savings apps. It’s basically an online piggy bank. Have money left over from your previous check that you don’t need? Send it to the app. Have a freelance/collaboration job you we’re expecting? Send it to the app. It’s a great way of sending over small amounts of money over the year without realizing it. I used the money I accumulate each year to pay for Christmas gifts. I don’t have to worry about going into debt and I can see how much I have at any given time. (FYI: this isn’t sponsored or paid; I just really love this app).

IV. You don’t need that Starbucks every day!

I’ll have a tall caramel macchiato with almond milk. That was my go-to Starbucks drink every week day. I didn’t realize how much it was costing me until I actually added up what I was spending my money on each month. Now I’m not one of those people that tell you to go cold turkey and make all your coffee at home, but I did invest in a Keurig and make my coffee at home 2-3 times a week….5 bucks a pop for 3 days = 15 dollars a week * 52 weeks = $780 dollars!!! So yeah…little changes do add up.Don’t have a coffee habit? What about eating out for lunch every day? Happy hours with the girls/co-workers after work 2-3 times a week? Find that one thing you’re spending too much money on each month and try to cut it in half and watch it make a difference to your coins.

V. Clean up your closet…organize…organize…organize…

I know you’re probably thinking? What does my closet have anything to do with my coins? Plenty that’s what. Picture this, you’re at the mall shopping, looking for something to wear to a concert or lounge and can’t remember if you have that skirt or those shoes in that color. Only to come home and realize you have something very similar to what you bought already in your closet…now you have 2 of the same piece of clothing and one eventually going to goodwill…you just wasted your coins buying something that you didn’t need because your closet was organized.I have a 1 in 1 out method. If I buy 2 tops, 2 tops in my closet have to go. Same goes for shoes or handbags or even bras. I know what’s in my closet at all times and when I go shopping, I try to visualize what I will be trashing if I buy that item and if it’s worth me throwing away something I already have. It may not totally curve your shopping habit but it will help.

I know you’re probably thinking? What does my closet have anything to do with my coins? Plenty that’s what. Picture this, you’re at the mall shopping, looking for something to wear to a concert or lounge and can’t remember if you have that skirt or those shoes in that color. Only to come home and realize you have something very similar to what you bought already in your closet…now you have 2 of the same piece of clothing and one eventually going to goodwill…you just wasted your coins buying something that you didn’t need because your closet was organized.I have a 1 in 1 out method. If I buy 2 tops, 2 tops in my closet have to go. Same goes for shoes or handbags or even bras. I know what’s in my closet at all times and when I go shopping, I try to visualize what I will be trashing if I buy that item and if it’s worth me throwing away something I already have. It may not totally curve your shopping habit but it will help.

VI. Create a budget and treat it like your Bible

Many people create a budget and many of those people don’t follow their budget. Things come up and events beyond your control happen but it’s important to find/create a budget that flexible to your situations but also allows you to maintain and reach your financial goals. Here are a few budgeting tools that are my fave:Monthly Budget TemplateSimple Budget TemplateFamily Budget TemplateYearly Budget Template

VII. Use those credit cards in moderation

Credit cards can be the biggest burden or the best factor in terms of your financial success. It can be considered good debt if you’re paying it off each month but can be the biggest burden to your finances if you’re carrying over a balance month after month. Interest on a credit card it most time higher than the interest on anything else you may own (house, care, student loans) so it’s important to get those under control and paid off ASAP. After you have those under control, check to see if the benefits of your cards. It may be beneficial to use a card for all your expenses and then pay it off at the end of the month. Make sure you understand the closing cycle and when interest charges occur before delving into that direction. You don’t want to pay money to the credit card company just to be able to use a card.That was a lot but I hope it helps you in your financial journey.~Cocoa Curls

Credit cards can be the biggest burden or the best factor in terms of your financial success. It can be considered good debt if you’re paying it off each month but can be the biggest burden to your finances if you’re carrying over a balance month after month. Interest on a credit card it most time higher than the interest on anything else you may own (house, care, student loans) so it’s important to get those under control and paid off ASAP. After you have those under control, check to see if the benefits of your cards. It may be beneficial to use a card for all your expenses and then pay it off at the end of the month. Make sure you understand the closing cycle and when interest charges occur before delving into that direction. You don’t want to pay money to the credit card company just to be able to use a card.That was a lot but I hope it helps you in your financial journey.~Cocoa Curls